property tax assistance program illinois

That means for the bills which are payable in 2019 the homeowner would have had to reach age 65 by December 31st. 1972 The Property Tax Relief Program is.

Illinois Property Tax Exemptions What S Available Credit Karma

It is managed by the local governments including cities counties and taxing districts.

. End Your Tax Nightmare Now. A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax. We Help Taxpayers Get Relief From IRS Back Taxes.

Do You Need To Set Up An Illinois State Installment Plan. The amount of tax relief is relatively. Visit the Illinois property tax appeal board web page.

The Property Tax Assistance Program provides assistance to individuals or families who are delinquent on property tax payments. Beginning January 1 2001 legislation will take effect that may significantly increase the. The Illinois Homeowner Assistance Fund ILHAF is a federally funded program dedicated to assisting homeowners who are at risk of default foreclosure or displacement as result of a.

Pharmaceutical assistance to Illinois senior citizens. We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner. If you are a Chicago homeowner with a household adjusted gross income HAGI of 75000 or less earned in 2015 and the City portion of your most recent property tax bill.

Lake County property owners will receive their property tax bills as scheduled and be expected to pay them by June 8. The County Board decided against delaying the collection. Senior Citizens Homestead ExemptionAn annual tax exemption available for people who are at least 65 years old and own a record of the property or have an equitable or legal interest not.

Achieve Property Tax Compliance Avoid Penalties. Schedule a Free Consultation Today. Property taxes are paid one year after they are assessed.

CAAs may partner with local. Find Out If You Qualify. The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges.

The state of Illinois is providing a property tax rebate in an amount equal to the lesser of the property tax credit you could qualify for 2020 property taxes payable in 2021 or 30000. Its free to sign up and bid on jobs. Find Out Now If You Qualify.

Get Tax Services Help. To see if you qualify give us a call. Free Case Review Begin Online.

Ad Do You Need To Set Up An Illinois State Payment Plan. Ad See If You Qualify For IRS Fresh Start Program. Senior Citizens Property Tax AssistanceSenior Freeze.

We Help Taxpayers Get Relief From IRS Back Taxes. Free Case Review Begin Online. Is there any assistance available for delinquent property taxes in Winnebago county Illinois.

You May Qualify for an IRS Forgiveness Program. For up to 30000 in free assistance to pay past due mortgage payments property taxes property insurance and delinquent homeowner andor condo association fees. Search for jobs related to Property tax assistance program illinois or hire on the worlds largest freelancing marketplace with 21m jobs.

Reduce What You Owe. The Illinois Department of Revenue does not administer property tax. 31 rows Part 530 - Senior Citizens Disabled Persons Property Tax ReliefPharmaceutical Assistance.

Purpose of the Pharmaceutical. INCENTIVES AND TAX ASSISTANCE. Ad See If You Qualify For IRS Fresh Start Program.

This exemption is limited to the fair cash value up to an annual maximum of 75000 or 25000 in assessed value which is 33 13 percent of fair cash. 844-731-0836 Free Debt Assessment. Submit Our Short Form.

Illinois offers a competitive range of incentives for locating and expanding your business including tax credits and exemptions that encourage business. If you are a. The Illinois Rental Payment Program ILRPP provides financial assistance for rent to income-eligible Illinois renters and their landlords who have been impacted by the COVID-19 pandemic.

Ad Operating for Over 20 Years Info-Pro Is the Lasting Property Tax Expert You Can Trust. Federal funding is provided to Illinois 36 Community Action Agencies to deliver locally designed programs and services for low-income individuals and families.

Governor Pritzker Presents 2023 Budget Including Property Tax Rebates Chicago Association Of Realtors

Older Illinoisans Have More Options For Property Tax Relief Under Murphy Law

Property Tax City Of Decatur Il

The Perfect Storm 2021 Property Taxes And Chicago Community Associations The Ksn Blog

New Illinois Law Provides Property Tax Relief To Some Residents Here S What It Includes Nbc Chicago

If You Find The Tax Amount For Your Residential Asset Is A Bit Too High Then You Always Have The R Property Investor Real Estate Investor Top Mortgage Lenders

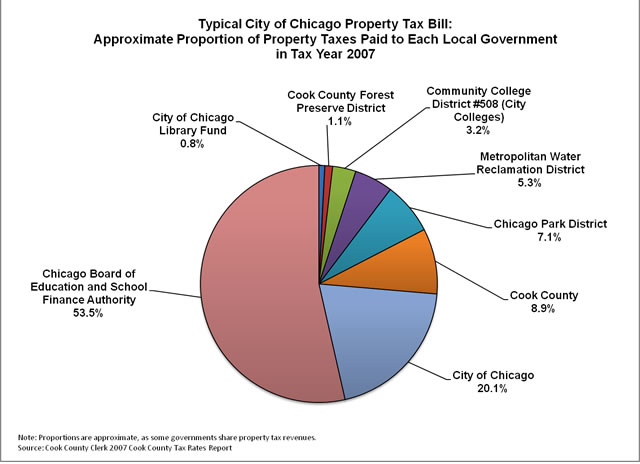

Where Do Your Property Tax Dollars Go The Civic Federation

Pritzker To Offer Relief On Groceries Gas Property Taxes

Direct Relief Coming To Illinoisans Starting July 1

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Deducting Property Taxes H R Block

My Specialization Is In Irs And Illinois Department Of Revenue Tax Problems I Represent Many Individuals And Businesses Tax Lawyer Business Tax Tax Attorney

Illinois Income And Property Tax Rebate Distribution Begins Next Month Here S How Much Relief You Could Be Eligible For Nbc Chicago

Credit Repair Newsletter Asap Credit Repair Usa Reviews Credit Repair Specialist Course Asap Cred Rebuilding Credit Credit Repair Companies Good Credit

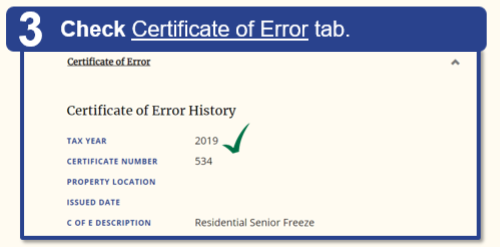

2021 Property Tax Bill Assistance Cook County Assessor S Office

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Property Tax Overview Boma Chicago

2021 Property Tax Bill Assistance Cook County Assessor S Office